Robinhood is driving the future of investing for the millennial generation. Before Robinhood there was no investment tool that allowed people to trade stocks and options without paying any fees. This means that it’s even easier for the younger generation to invest in amounts of less than $1000, since their payments aren’t eaten up by trading fees.

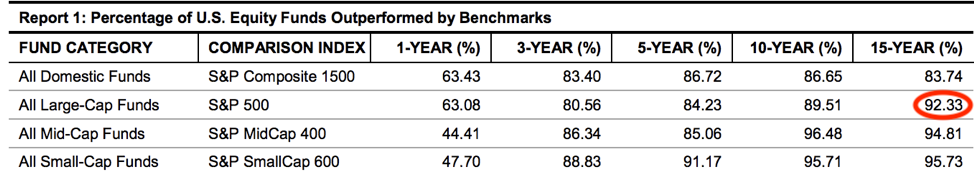

However, one of the problems with Robinhood is that it instills the idea that everyone can be a successful day trader. The initial watchlist includes stocks like Apple, Tesla, Netflix, and GE, without a single ETF. A study released by S&P Dow Jones showed that 92.33% of professional money managers could not be the market benchmarks, like an S&P 500 index fund, over 15 years.

Pay off loans before investing

This includes student loans, credit card loans and auto loans. By paying off student loan debt investors would essentially be getting a guaranteed return of 5%, since you wouldn’t have to pay any more interest on the loan. This means that millennials who are in or just out of college with student loan debt SHOULD NOT be investing with individual stocks on Robinhood.

Robinhood makes it even easier for investors to LOSE money through 2 tools

- Robinhood Gold allows users to trade on margin, which means that users are essentially borrowing money from Robinhood in order to put on more traders.

- Options also allow users to lose money faster than through regular stock purchases. This is because an options contract is executed in terms of 100 shares.

But even worse, Robinhood is selling buy orders to High Frequency Trading Firms

This is not uncommon and is performed by brokers like TD Ameritrade and Etrade. However, a writer named Logan Kane wrote that

” [Robinhood] appear to be selling their customers’ orders for over ten times as much as other brokers who engage in the practice. It’s a conflict of interest and is bad for you as a customer.”

On their website Robinhood claims that “Our financial system should work for everyone and not just a few.” However, Robinhood’s business model leads us to believe that they are manipulating the financial system to benefit the few at the cost of their users. The fact that Robinhood is getting paid 10x the amount of other brokerages indicates that Robinhood is able to provide some form of additional information on its users that is even more valuable for HFT firms.

Why do you think that HFT firms are willing to pay TEN times the amount for orders from Robinhood?